Create meaningful conversations about life's most important financial goals

Analyze and present on up to seventeen different areas of financial planning.

Create custom plans with reports that explain the need in simple, straightforward terms.

Social Security Planning

Quickly compare up to 3 different filing scenarios and identify the optimal filing strategy for any client or prospect. You can use this module to illustrate Social Security on its own or you can choose to incorporate benefits into a retirement savings or life insurance plan.

Personal Finance and Debt Planning

Examine cash-flow and debt repayment to help clients take

control of their finances.

A Module For Every Scenario

The Advisys platform has seventeen needs analysis concepts available. Each of these modules is designed to quantify a need on one page. This concept allows the financial professionals to explain the situation and make recommendations in just minutes

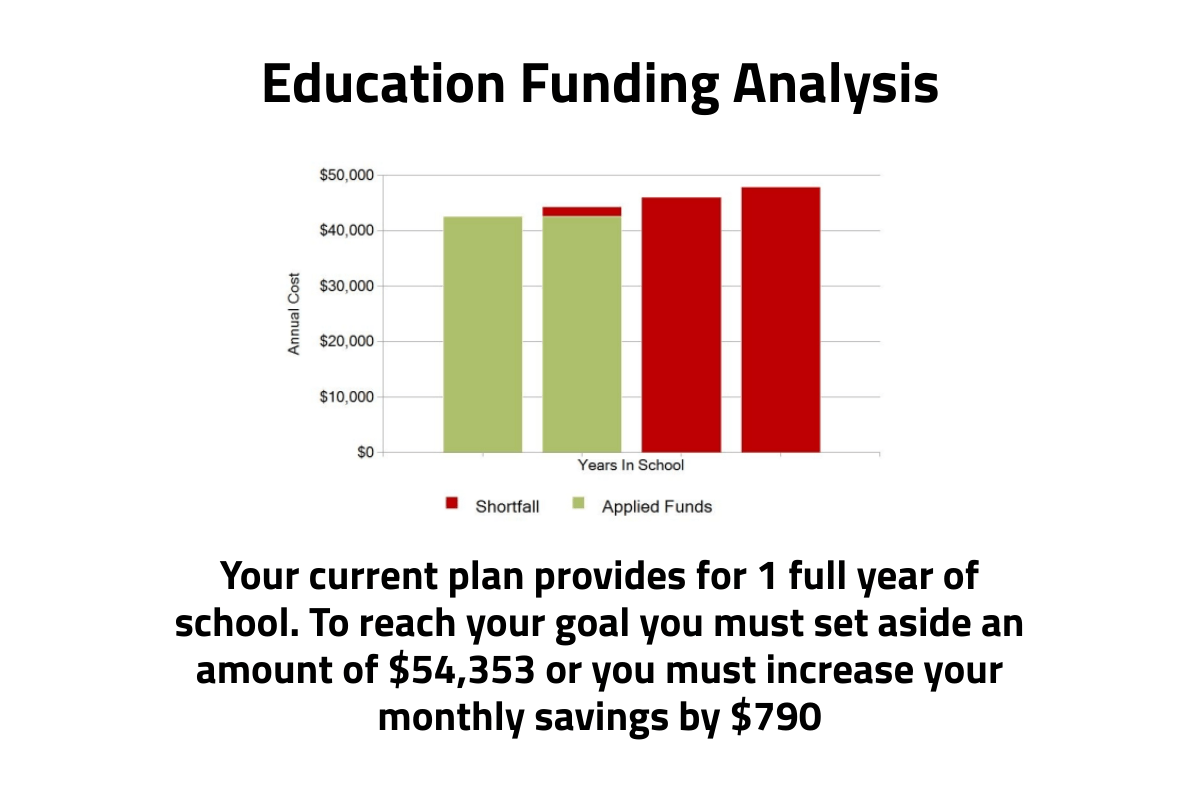

What will it cost to send a child to college and how does my existing plan compare?

Input:

Child date of birth, cost of college today, current savings

Output:

How much additional monthly savings are required.

Product Conversation:

College savings plan like a 529 or Coverdell Plan

What financial impact will the death of a client have on a family?

Input:

Clients and kids DOB, monthly expenses, current assets and insurance, current debt, final expenses & cost of college

Output:

How much additional capital is required to pay for immediate and ongoing expenses.

Product Conversation:

Various Life Insurance Plans

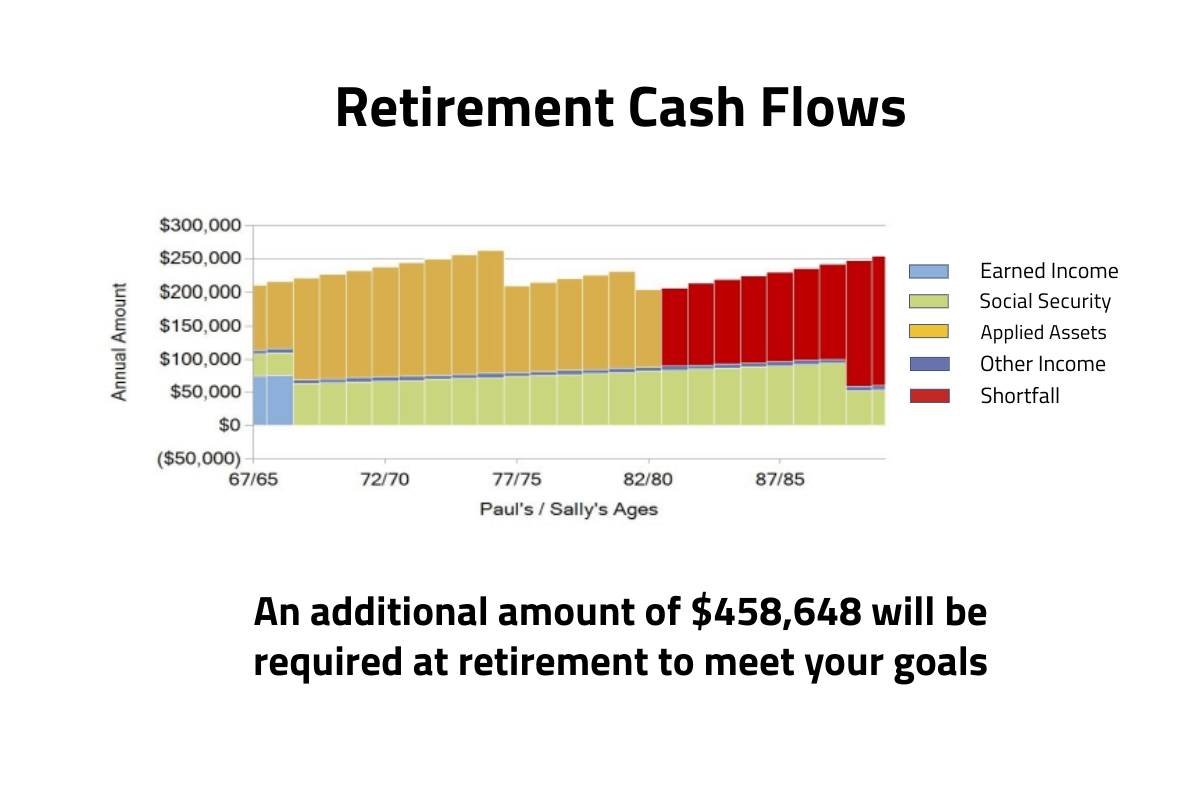

How does my current savings plan satisfy my retirement desires?

Input:

Clients DOB, desired living expenses during retirement, current income, assets and monthly savings

Output:

How much additional capital is required at retirement to fund the desired lifestyle?

Product Conversation:

Retirement Savings Accounts

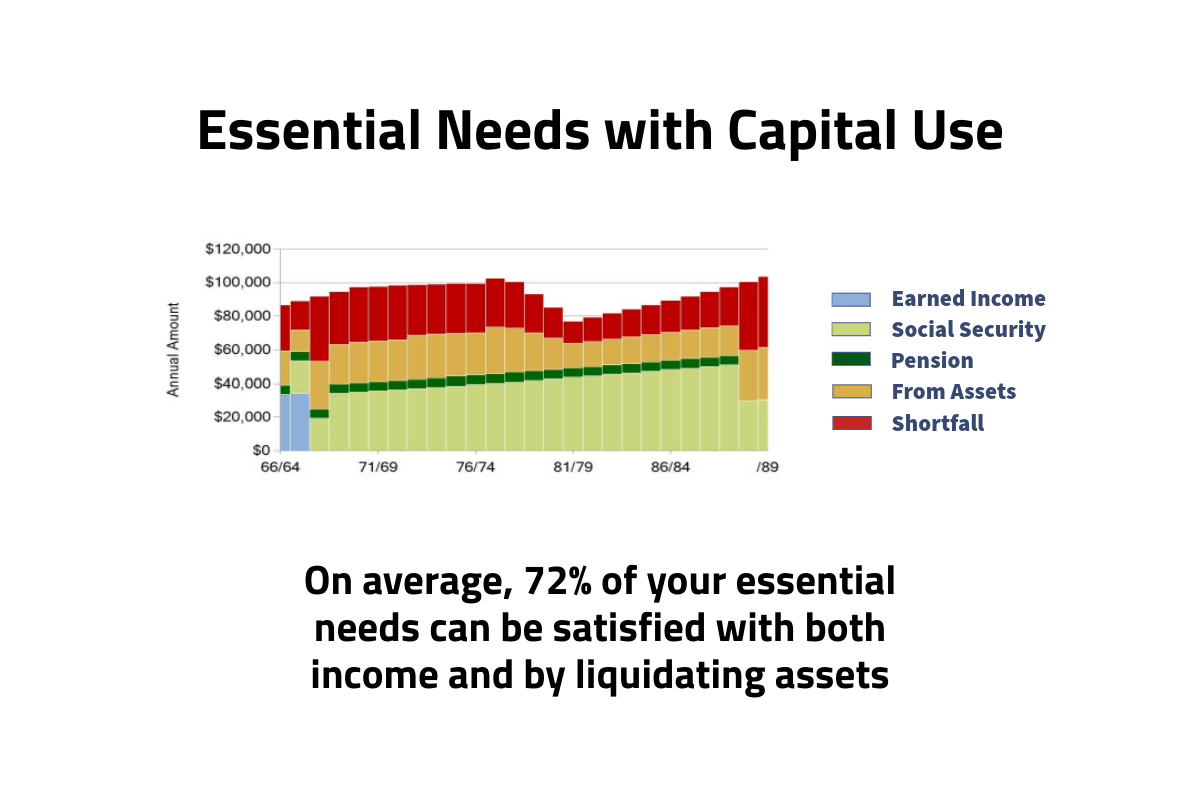

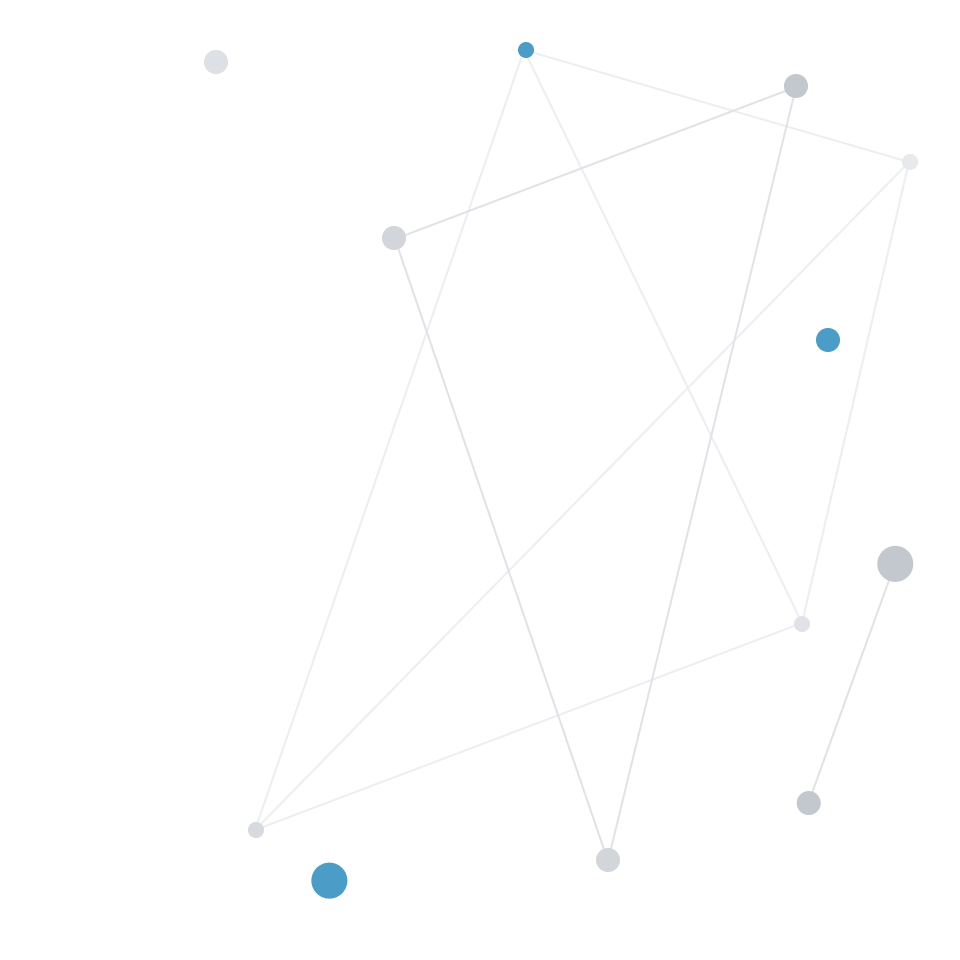

How do my income sources and capital satisfy my essential income needs?

Input:

Clients dates of birth, essential spending needs, desired spending, secure income, capital available

Output:

How much of my needs are covered with income that I can count on?

Product Conversation:

Annuities, Long-Term Care insurance policy

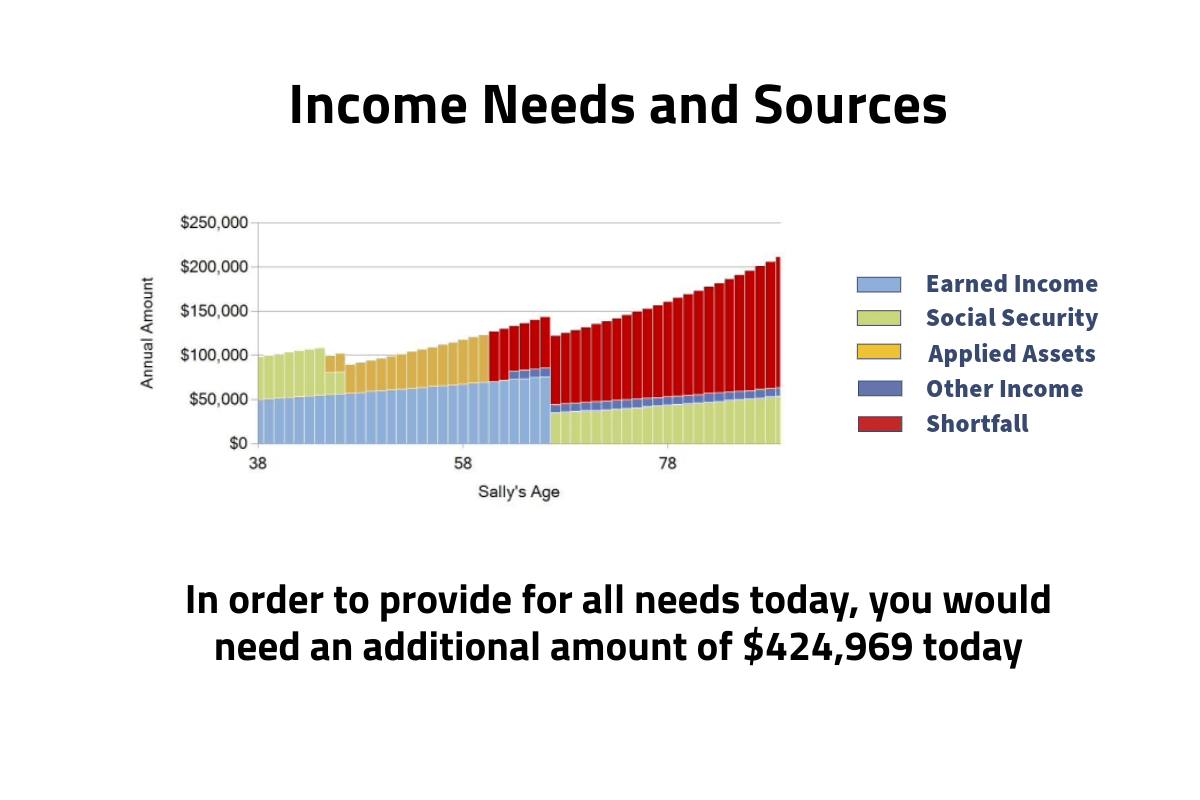

What role does Social Security play in my retirement and how can I maximize the benefits I receive?

Input:

Clients dates of birth, retirement age, ages to illustrate receiving Social Security benefits, income sources that offset benefits

Output:

For up to 3 scenario’s, annual benefits received, total benefits received and breakeven for the 3 scenarios

Product Conversation:

Retirement planning and products to supplement Social Security benefits.

How does a client’s current asset allocation compare with their risk tolerance?

Input:

Current assets by class, risk tolerance

Output:

Current portfolio compared to a portfolio that matches risk tolerance

Product Conversation:

Asset repositioning

How can I donate assets to a trust and have my heirs receive benefits?

Input:

Donor income beneficiaries. amount of assets transferred to trust, trust term and payout. Amount of insurance for wealth replacement trust

Output:

How does a wealth replacement trust work and what is the financial impact

Product Conversation:

Life insurance in a wealth replacement trust

What costs will be incurred at a death?

Input:

Assumed mortality age, current assets and growth rates, debt and desired bequests, current life insurance, probate, admin. fees and tax cost.

Output:

What assets if any will be left to the heirs of the client.

Product Conversation:

Life insurance

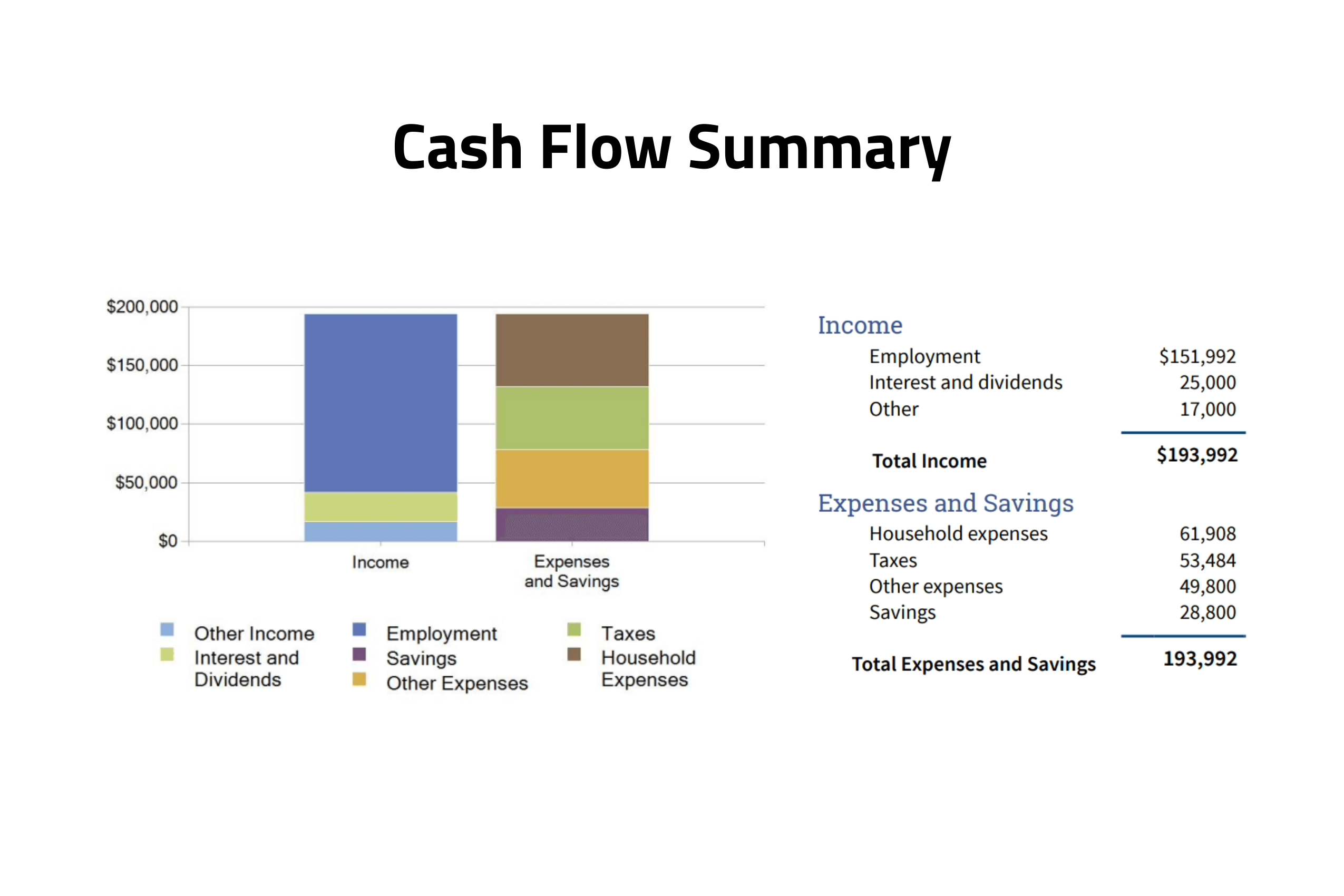

What is my current cash flow and net worth?

Input:

Current income, expense, monthly savings, assets and debt

Output:

How does current income compare with monthly savings and spending? What is the clients net worth?

Product Conversation:

Life insurance for debt repayment Debt consolidation

What is the best way to repay my debt?

Input:

Current debt amount, interest rate, monthly payment and repayment strategy

Output:

Repayment schedule and target dates for being out of debt

Product Conversation:

Insurance to pay debt in the event of premature death or disability

What will a future purchase cost and how does my existing plan compare?

Input:

When future purchase will occur, cost of purchase today, current savings

Output:

How much additional monthly savings are required?

Product Conversation:

Additional savings program

What will long-term care costs be and will my assets and insurance be able to pay for the care?

Input:

Client DOB, current LTC insurance benefit, current assets, cost of long-term care

Output:

How much will it cost to self-insure long-term care needs

Product Conversation:

Long-Term Care insurance policy

How much income will be available if a client becomes disabled?

Input:

Client DOB, current earnings, amount of earnings to be available if disabled, current disability insurance benefits

Output:

Income shortfalls for each year until retirement

Product Conversation:

Disability income replacement Insurance

Will current insurance, if any, cover all of the costs that can be incurred if a critical illness occurs?

Input:

Income replacement needs, additional domestic and childcare help. Home modifications and medical needs, current critical illness insurance

Output:

How much insurance is needed to cover the costs incurred from a critical illness?

Product Conversation:

Critical Illness Insurance

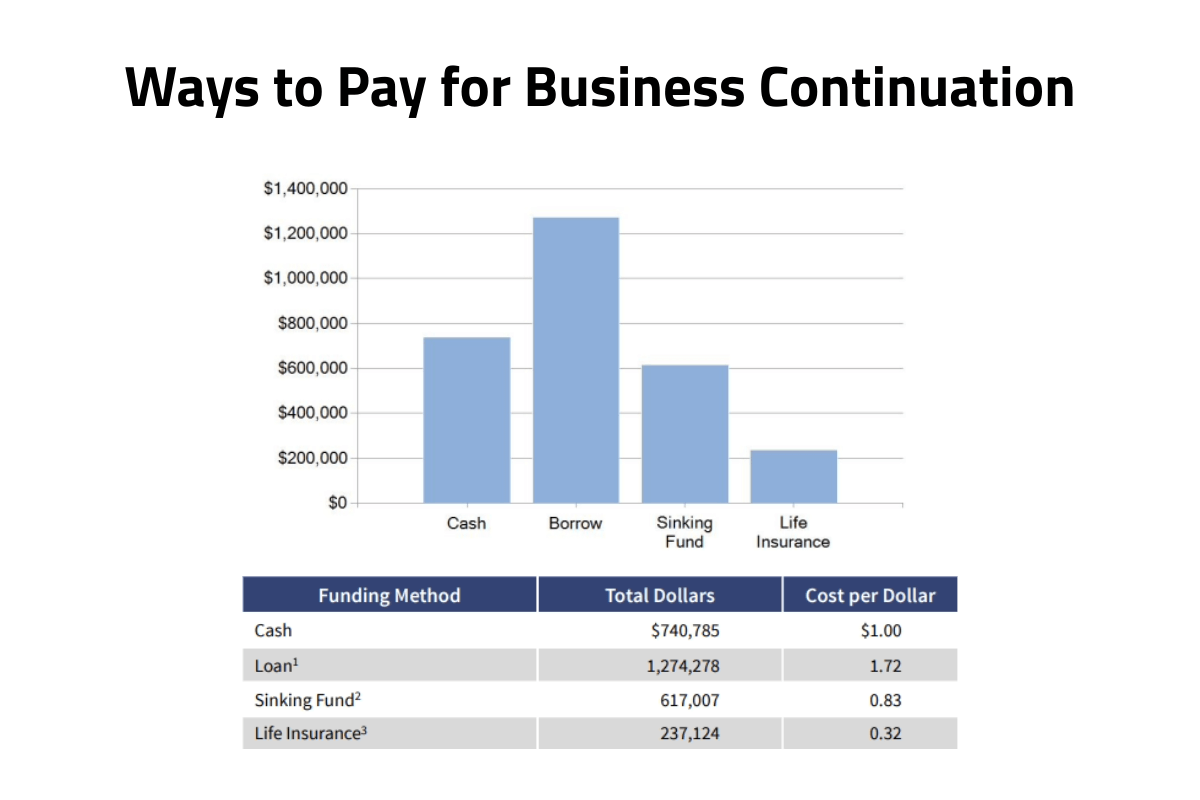

What will it cost to purchase business interest from a partner or partners heirs?

Input:

Current value, percent of business owned, estimated annual growth rate, current life insurance available

Output:

How much additional capital is required to purchase a business partner’s interest?

Product Conversation:

Buy-Sell life insurance

What is a business worth and what will it cost to purchase business interest from a partner or partners heirs?

Input:

Business financials and growth projections, percent of business owned, current life insurance available

Output:

Knowing the value of the business, how much capital is required to purchase a business partner’s interest?

Product Conversation:

Buy-Sell life insurance

What is a key employee worth and what are the costs of replacement?

Input:

Key employees’ contribution to the business, replacement costs

Output:

How do I protect the company against the loss of a key employee

Product Conversation:

Key employee insurance